What Kind Of Kids Bank Accounts Are Available

There are both savings and chequing accounts available for children, though chequing accounts tend to have a higher minimum age. Many banks offer savings accounts for children of any age, including accounts for babies.

You can also open an account that your kid wont have access to until they come of age, which is usually 18 or 19, depending on your province or territory. A custodial account allows you to continue adding money as your kid grows up so that they can use it to pay for college or any other expense when theyre older.

Your Right To Open A Bank Account

In Canada, you have the right to open a bank account at a bank or a federally regulated credit union as long as you show proper identification.

You can open an account even if you:

- dont have a job

- dont have money to put in the account right away

- have been bankrupt

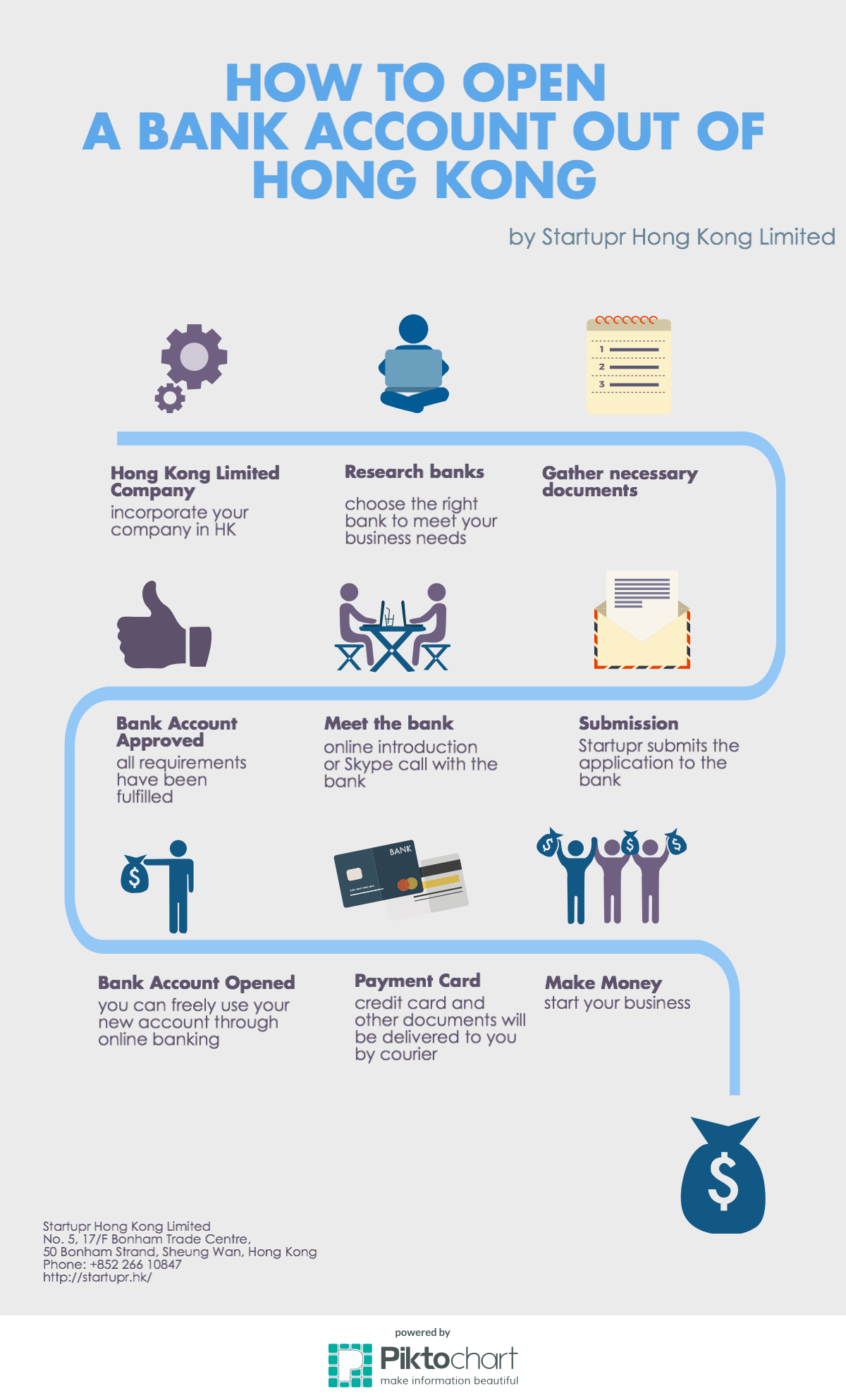

To open an account, you usually have to:

- go in person to a financial institution

- provide an acceptable form of identification

Contact the financial institution to find out if there are other ways to open an account. Financial institutions that operate only online may require that you have an existing account with another financial institution before opening an account for you.

Benefits Of Having An Anz Progress Saver

ANZ Progress Saver gives young people a good introduction to the benefits of saving regularly and earning interest.

- $0 monthly account service fee

- Under 18s can apply for a ANZ transaction fees waiverdisclaimer

- Set up regular deposits to help them save

- Track their progress with a savings graph on every statement

- Qualify for bonus interest when they make at least a single deposit of $10 or more in a month and no withdrawalsdisclaimer

Deposit at least $10 once a month.disclaimer

Make no withdrawals , or incur any fees and charges in the month.

In any given month they could earn

Total rate = Base interest + Bonus interest

Recommended Reading: Can Newborn Sleep Without Swaddle

How Do Savings Account For Babies Work

Savings accounts for babies work in the same way as adult accounts, but interest rates are typically more competitive.

Parents or grandparents can open a savings account with a bank or building society on the childs behalf and, depending on the account, your child may be able to start managing it themselves when they reach the age of seven. Most accounts can be opened with as little as £1.

Best Bank Accounts For Kids In Canada

Most savings accounts for kids are designed to cater to them until they reach age 18 or the age of the majority in their province.

To make it worthwhile, ensure that the account you sign them up for has no monthly fee and allows a reasonable number of transactions per month for free.

The savings account should also offer to pay interest so that your child can watch their balance grow with time for a practical and valuable lesson on investment returns and compounding interest.

You May Like: What Items Do You Need For A Newborn Baby

Benefits For The Minor

The funds in a custodial account legally belong to the child, and any deposit made to the account is an irrevocable gift. While they can’t take the funds back, the adult will make decisions and handle the logistics of the account .

The adult has a legal obligation to use the money for the childs benefit. In other words, the adult cannot buy luxury items for personal use because that would be stealing from the child. Paying for the minors education or buying them a car, on the other hand, are most likely acceptable expenses.

Making A Millionaire: The Power Of Starting Young

Imagine you and your teenager deposit $6,000 into a Roth IRA every year for five years, from the time theyre 14 to the time theyre 19. At an average return of 10% in line with historic S& P 500 returns theyd have $40,293.66 in the account after those five years.

Then say they never invested another cent. The account simply compounds on itself for the next few decades, quietly growing in the background with neither deposits nor withdrawals.

Thats the power of compound interest: Time does the heavy lifting for you.

Also Check: How Can You Adopt A Newborn Baby

Whats A Custodial Account

A custodial account is an investment account that parents can put money into for their kids. Custodial accounts can be opened with a $9/month Stash+ subscription on Stash.

Funds put into a custodial account are considered a gift and become the childs money as soon as the account is opened. However, the child usually doesnt have access to the funds until they turn 18, or until their parents choose to give them access to the money from the account.

Many parents choose custodial accountsbecause of the flexibility they allow for, since the funds can be used for education or any other purpose that benefits the child.

Custodial accountsmay not be ideal for teaching children short-term lessons about saving, spending, and budgeting, but they can demonstrate the benefits of long-term investing, along with the benefits of earning interest over time. You can see how it works by opening a custodial account for your kids as part of a $9/month Stash+ subscription on Stashand start your kids on the path to learning about how money works today.

Find A Bank That Promotes Financial Education

There is nothing wrong with opening a standard adult savings account and having your child put his or her allowance in there. But some financial institutions make saving fun and teach kids good money habits. Ask a banker and check the banks website for money tutorials for young people.

The Consumer Financial Protection Bureau website, a financial regulatory and education agency, is also a good place to find information on this topic.

Here are some savings options for children. Brick-and-mortar banks may offer UGMA or UTMA accounts, depending on the bank and the state. But the interest rate may be substantially lower than at an online bank that offers a custodial account, in some instances. An online bank may allow its savings accounts, even if they arent specifically childrens savings accounts, to be titled as an UGMA or UTMA account. Generally, childrens account options have low minimum balance requirements.

Bank of Americas site has educational content teaching children about money.

Also Check: How Much Formula Do I Give My Newborn

Newborn Baby Tips: Common Sense Advice For New Parents

Huffington Post

As any expectant parent knows, theres no shortage of advice available for all things baby-related. Look no further than the enormous Parenting section at the bookstore as proof or the exponential growth of Mom blogs, for that matter.

With so much advice out there, its difficult to make even the most basic decisions, from what type of diapers to buy to what kind of food to nourish your little bundle of joy with. To make things a bit less complicated, weve compiled some of the most reliable, tried-and-true, common sense advice available to help guide you through some of your most pressing baby-related conundrums.

Midwife or doctor?

The midwife vs. doctor debate is a very entertaining ongoing storyline on The Mindy Project. Mindy Kalings character, an ob-gyn, convincingly argues that doctors are the way to go because theyre equipped to handle complications that may require, say, an emergency C-section.

Of course, you may be looking for more substantial pros and cons than those offered up as sitcom fodder. This in-depth TIME article provides a comprehensive look at both sides of the debate. Ultimately, this is a very personal decision that comes down to your own preference. Midwives do offer unique advantages. For instance, if you have your heart set on a water birth outside of a hospital setting, midwives can offer more flexible, customized birth plans for low-risk pregnancies.

Breast-feeding or bottles?

Organic food or conventionally grown?

Explain To Your Child How Putting Savings In A Bank Makes Sure Their Savings Are Protected

It’s an interesting discussion to have with children. There’s a balance here: a piggybank is kept at home where you can see it, but it can be stolen . Yet money in the bank is safe and earns interest, though there’s a slight risk the bank may collapse.

If it does, provided it’s a UK-regulated account the money is protected up to £85,000 per person by the Government, which is as safe as we can hope for. See our Safe savings guide for more.

Read Also: Why My Newborn Has Diarrhea

Are They A Good Idea

As well as helping your child learn more about money and develop good savings habits, opening a savings account for your baby can help ensure they have funds to fall back on as they grow up.

The money saved can help pay for your childs education, enable them to put down a deposit on a house, help pay for their wedding, or even allow them to travel the world.

Different Savings Plans: Emergency And Opportunity Savings

There are two kinds of savings you can utilize to start an account for your kids, but both involve storing up cash. An emergency fund is usually held at a bank or credit union, whereas opportunity money is often held in a piggy bank.

The best time to open these accounts will vary greatly depending on the developmental levels of the child. But a good rule of thumb is when the child can understand the value of money they can understand the idea that storing up that money will allow them to make larger purchases. By the time they are in first grade, most children will have a good grasp of these concepts this is a great time to start a savings account for a child.

Also Check: How To Start A Routine With A Newborn

Setting Up Bank Account For Baby Let Me Walk You Through How To Do It Considerations To Make And One Of The Best Savings Plan For Children

I’ve made it through cloth diapering, 2:00 a.m. feedings, and car seat installations.

Now, I’m totally in the mode for setting up bank account for baby!

Our little one made his debut over a year ago. Being the financial nerd that I am plus a darn good planner I thought it would be awesome for me to set up a savings account for baby now while he’s still in diapers to catch all of the generous birthday + holiday cash gifts throughout his childhood.

I mean, can you imagine the possibilities of how much that account could earn for him over the next 18 years?

That was 13 months + about 1,000 diaper changes ago. *womp, womp*

But you know what? There’s no better time than today for me to do this, or for you to do this .

Here’s what to consider when setting up bank account for baby.

Article Content

Which Bank Should I Choose

Get personalized bank recommendations in 3 easy steps.

Get started

Every parent wants to see their child flourish, and heres one great and easy way to help make that happen.

Teaching them about money while theyre young by opening a savings account is a great way to help them mature and become financially responsible. Theres no better way to learn about money than with a custodial account.

Custodial accounts can be Uniform Gifts to Minors Act or Uniform Transfers to Minors Act accounts. With an UTMA, any kind of property, whether its real or personal, tangible or intangible, can be transferred to a custodian for the benefit of a minor, according to the Social Security Administration. An UGMA account only allows gifts of cash or securities.

Whether youre able to open an UGMA or an UTMA for a child will depend on the bank and the state that you live in, according to the United States Office of Government Ethics. If a bank doesnt offer custodial accounts, an adult may be able to open a joint account with a minor child. Check with your bank. And if it is a joint account, be aware that your child may have full access to this account. With an UTMA, children generally cant access these accounts as minors.

Look for a childrens savings account with no maintenance fees, no minimum balance requirement and a high annual percentage yield . A high yield is important so that children can really see money earmarked for their future grow, and to keep up or stay ahead of inflation.

Recommended Reading: What To Wear For Newborn Family Photos

Get Personalized Insights With Nomi

See what you spent on takeout â and more.

Get personalized insights with NOMI

Want to know how much you spent last month or if a payment might be due? NOMI Insights can tell you this and more. It can even let you know if an unusual transaction was made on your account.Onlyavailable in the RBC Mobile app.

Get the app that gets you.

RBC Mobile Student Edition gives you quick access to the features that students use the most.

Check your credit score for free.

Easily access your credit score in RBC Online Banking without impacting your credit rating.

Safely shop online.

With Virtual Visa Debit, you can make secure online purchases using the money in your bank account.

Get a head start on investing.

Pay no management fees when you open an RBC Direct Investing account as a student.

See more of your favourite events.

Receive exclusive access and ticket discounts to see your favourite artists, sporting events and performances.

How Do I Open And Manage My Account

All parties must be resident in the UK to apply

If youre aged 18 years or over, you can open an account in trust for a child aged up to 16 years

If youre aged between 7-16 years, you can open an account in your own name with the consent of your parent or guardian.

You can open and manage your account on our mobile app, online or by telephone.

To open in branch you must bring your own digital device such as a mobile or tablet and our staff can assist you opening the account yourself.

There is no minimum deposit required to open the account no minimum deposit needs to be made on a regular basis and there is no maximum balance limit.

Recommended Reading: How To Produce Breast Milk For Newborn

Saving For A Baby Rewarded

We want to encourage our customers to save for their children. We will give a gift for your baby aged less than six months when you start regular saving for your child and direct the child allowances to your account in Nordea. The gift is worth 20 euros when you start regular saving in an account and 40 euros when you start regular saving in a fund.