Bajaj Allianz Health Care Supreme

The plan is a comprehensive health plan. The Bajaj Allianz Health Care Supreme offers a coverage Rs 5 lakh-Rs 50 lakh. However, it is offered as a part of its maternity section, a newborn Child Plans is covered with a sum of up to Rs 1 lakh, up to 90 days of his age. Additionally, the plan comes out with a wide range of both inbuilt benefits and add-on coverage features and allows you to customize the coverage as per your requirements. The main feature of Bajaj Allianz Health Care Supreme are:

What You Need To Know About Insurance Policy For New Born Baby In India

The birth of your child is, without a doubt, one of the happiest moments of your life. After all, your family has a new cute little bundle of joy that is there to spread joy in your lives. But being a parent also entails various responsibilities which you must take care of. One of the most important responsibilities that you have as a parent is to ensure the health and wellbeing of your new-born baby under all circumstances. As the cost of quality healthcare has skyrocketed in the last few years, it has become imperative to subscribe to comprehensive health insurance for a new-born baby that caters to all aspects of the overall wellbeing of your baby.

Can You Buy Health Insurance Just For Your Newborn

Child-only health plans may make sense in certain situations. You may have employer-sponsored insurance with no option to include children, or you may qualify for Medicare, which doesnt offer dependent coverage.

If you need a child-only plan and dont qualify for Medicaid or CHIP, visit the federal or state Marketplace. Depending on your income, you may qualify for subsidies.

You may be able to buy a child-only plan directly from an insurance company, though it will likely cost more if its available.

In your search for options, beware of short-term and catastrophic plans, which may not include coverage for maternity care or for newborns.

Read Also: When To Use Soap On Newborn

Covered California Quotes For Individuals And Families

The Covered California Health Exchange is a government agency that helps Californians comply with Obamacare. To comply with Obamacare, you need to have insurance coverage from a qualified health plan that meets the governments requirements. While you usually can only enroll during the open enrollment period, the birth of a child gives you the ability to apply for Covered California health insurance outside of the open enrollment period.

Parents who are expecting a newborn may want to consider shopping for a new insurance plan for the following reasons:

- The cost of adding your newborn to your pre-existing plan is high.

- You and your partner do not currently have insurance.

- You and your partner would like to get on an insurance plan together when the child is born.

Fill out a simple online form with some basic information, including your income, and youll see a variety of plans in your search results. The details you will be able to compare include:

- Carrier Name

- Plan Category

- Plan Type

- Full Price of Plan

- Subsidy Amount You Qualify For

- Link to View Benefits

Your income level may qualify you for discounted rates all of which you can find on the Health for America website. There are additional parameters for pregnant women with low incomes, too. As a female who is expecting, you could qualify for Medi-Cal. Entering your household income information in the optional section of the forms will ensure all of the plans you are eligible for will appear in the results.

How Much Does Newborn Insurance Cost In Hong Kong

It is important to know that for most insurance providers, premiums for stand-alone child policies dont really vary depending on the age of the child . Annual premiums for comprehensive stand-alone policies for children from birth to 18 vary between HK$15,000 and HK$35,000 for inpatient and outpatient coverage that would reimburse you in full for private medical fees in Hong Kong.

Also Check: Can I Use Water Wipes On Newborn Face

How Can You Make Sure Your Newborn Is Covered

Remember that your infant should automatically receive coverage for at least the first 30 days of life. Youll want to ensure your baby gets covered after thatthe cost of essential immunizations, screenings, and other necessary medical exams can mount up.

The earlier you start inquiring about newborn health insurance to continue coverage after day 30, the better. Check in with your insurance provider about the terms of their special enrollment period for qualifying life events.

If youre currently not covered by any plan, several government programs can cover essential health services for your infant.

If You Already Have Personal International Health Insurance

First option, you are covered for maternity in your international health insurance coverage. This is the most desirable situation for you and your baby as you will be covered in case of complications related to childbirth. You can also ensure that your baby is covered from his date of birth onwards by adding him/her to the mothers policy within 30 to 90 days after the birth. In this case, your child is added to the policy with MHD with a possibility to cover congenital conditions. This is extremely important as it means your child is covered for pre-existing conditions at birth.

Second option, one of the parents has an international plan that has been effective for more than 12 months without a maternity option. With some insurers, you can add your infant to your health insurance plan with MHD as well that is your child can be added from his/her first date of birth or at a pro-rata premium . Take note that for most insurers, your child needs to be covered under the exact same benefits as the parent.

Lastly, complications of childbirth can easily escalate to HK$300,000+ in Hong Kong private hospitals. It is important to double-check the cover for this. The vast majority of maternity benefits cover complications of pregnancy in full for both mother and child and this until discharge.

Read Also: What Color Should My Newborn’s Poop Be

Is The Birth Of A Child A Qualifying Event

Yes, having a baby is considered a qualifying event. When a qualifying event occurs, the primary insured individual qualifies for a special enrollment period where they can make adjustments to their health insurance.

According to HealthCare.gov

For people with Marketplace health coverage, the SEP window is 60 days after the birth of the child/children.

Drawbacks Of Not Having Health Insurance For Newborns

It is a relief to have health insurance as a backup in case of any complications or other medical requirements. However, if you do not opt for medical insurance for infants, you might have to bear the financial brunt of paying for the hefty medical bills.

Apart from the emotional strain of facing any health complications during delivery, you wouldnt want to worry about the expensive treatment. With health insurance for newborns, you can make sure your precious one gets timely medical attention in case of immediate hospitalisation.

Don’t Miss: How Often Can I Bathe My Newborn

Important Things To Remember For Health Insurance For New

Here are some of the most important aspects of health insurance for new-born baby which you must be through with to avoid any unwanted eventualities: –

– Your dependent child will be covered under the family floater plan till the age specified by the insurer. Afterward, he/she must get an independent health insurance policy.

– There are some health insurance plans that offer coverage for a newborn baby right after birth.

– Opting for online health insurance for new-born baby allows you better control over the features of the policy as well as the benefit of enjoying lower premiums.

– Getting a health insurance for a new-born baby will allow your child to enjoy the benefits of lower premiums and higher coverage for the entire life.

– Income tax benefit under Sec 80D for the health insurance for new-born baby is available only to the individual from whose account the payment has been made.

– You always have the option to increase the sum insured for the health insurance for new-born baby at the time of policy renewal.

– You get the benefit of a no-claim bonus for every claim-free year of the policy.

The Mother And/or Father Has An Individual Or Family Health Insurance Plan

If you have an individual or family health insurance plan, call your insurance company directly and talk to them about what options they offer for adding a newborn to your plan. You should ask them questions such as:

- How much will it cost to add my newborn to my individual or family plan?

- What process do I need to follow to get my newborn added to my plan?

- When will coverage begin for my newborn?

- Will the coverage for my newborn be the same as my coverage?

If this is not your first child, you may be pleasantly surprised to find that the increase you had with the first baby will not occur with your second or third. Its also important to note that when you add another child to the family, its often worth revisiting health insurance plans for the entire family. For example, you may have your child on a separate plan, but now that you have two children, there may be a better family plan rate available.

If parents are not on the same individual or family health plan, its important to compare coverage to see whether the mother or fathers health insurance policy offers the better value for the newborn. This may also be an opportunity to get more value from your health insurance policy by searching for a family health insurance policy that covers both parents and the new child.

Don’t Miss: When Should You Bathe Your Newborn

Maintaining A Healthy Pregnancy

The Public Health Agency of Canada has developed the Sensible Guide to a Healthy Pregnancy, which includes useful tools and advice for pregnant women. Good nutrition and health, before and during the pregnancy, influence the health of the developing baby.

The week-by-week pregnancy calendar allows you to follow your babys development.

The Canada Prenatal Nutrition Program is designed for pregnant women and new mothers facing challenging life circumstances, such as recent arrival to Canada lone or teenage parenthood poverty and social or geographic isolation. Services offered by the program vary by location, but often include: nutrition counselling food preparation training food, food coupon or prenatal vitamin supplementation breastfeeding education and support prenatal health and maternal lifestyle counselling education and support on infant care and child development and referrals to other agencies and services as required.

Programs to help women maintain a healthy pregnancy may also be offered by your provincial or territorial government.

Special Enrollment Having A Baby Or Adopting A Child

Congratulations! Welcoming a new child into your home is an exciting time with many things to consider. We’re glad you’re thinking about your child’s health insurance. Adding to your family size is a qualifying event. This means you can enroll in or change your health insurance coverage during a special enrollment period.

Additionally, if you were ordered by a court to provide health care coverage for a dependent, you may also qualify for a special enrollment period.

Keep in mind you only have 60 days to enroll in health insurance after your baby is born or adopted or you gain a dependent through a court order. After that, you’ll have to wait until open enrollment.

Read Also: What Should A Newborn Schedule Look Like

List Of Participating Providers

If you already have a pediatrician selected, check the list of participating providers to ensure that your choice accepts your new plan. Its a good idea to make sure that you have several participating providers in your area in the event that your physician exits the plan or you want to change offices.

Breast Pumps Are Free

Yes ladies, you read that right. You do not have to pay for a breast pump, as the ACA mandates that they are covered at 100% with a prescription.

Your health insurance plan must cover the cost of a breast pump. It may be either a rental unit or a new one youll keep. Your plan may have guidelines on whether the covered pump is manual or electric, the length of the rental, and when youll receive it . – healthcare.gov

Call your insurance company to find out which brands they cover and how you need to purchase it, as it varies by insurer. If you need additional supplies, check out companies like Aeroflow* to see if the supplies can be covered by insurance rather than paying full price at a store.

*The Healthcare Hustlers earns commissions to support this website from qualifying purchases from Aeroflow.

Recommended Reading: Why Do Newborns Cry For No Reason

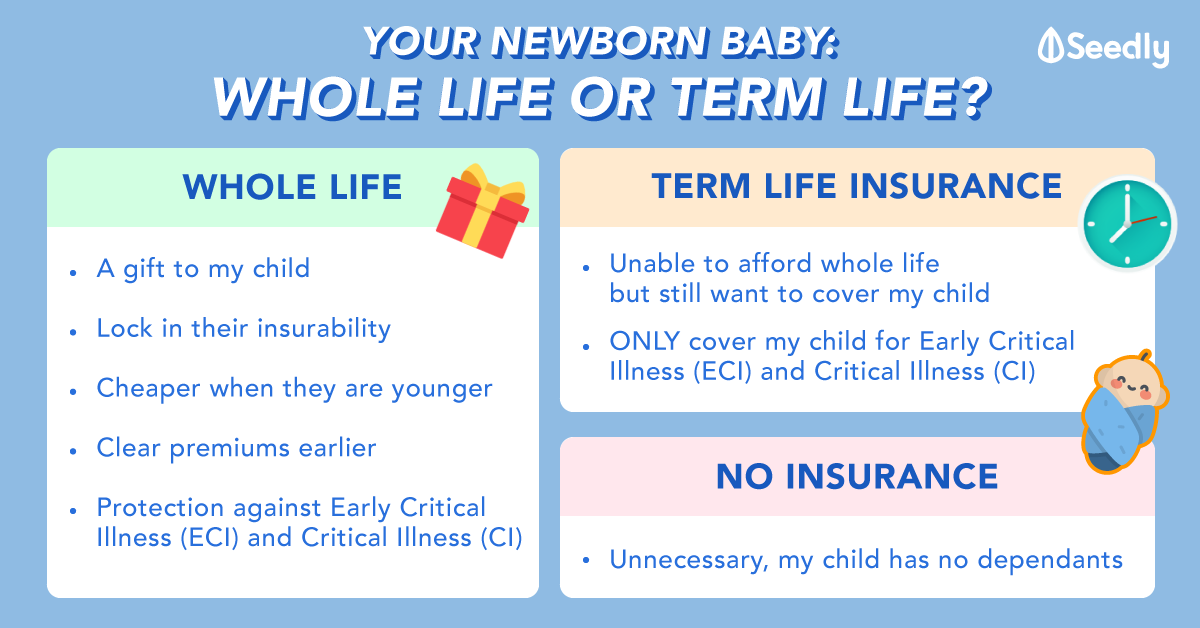

Why You Should Buy Insurance For Your Newborn As Early As Possible

Most people understand the importance of insurance. We pay a premium to buy insurance policies in exchange for the protection it gives us. Insurance provides coverage for us and our families when unexpected events strike. This includes death, critical illnesses or hospitalisation, which may result in hefty medical bills or other associated costs being incurred.

Most working adults in Singapore would have some form of insurance coverage, be it from the policies that they bought for themselves, or group insurance plans that their employers have provided for them as employees.

When it comes to having a baby, the responsibility will lie with parents to understand the importance and coverage levels that is adequate for their child. Getting insurance coverage as early as possible may also be wise. Here are three reasons why.

#1 No Exclusions

Many newborn babies are blessed with a clean bill of health. What this means is that when you buy an insurance policy for him or her, there will not be any exclusions tied to it. This is in contrast to an older child who may have pre-existing conditions and may only receive coverage with some exclusions.

The reality of life is that as children, and people in general, age, there is always a chance that they will get into accidents and they will fall ill, and in some situations more serious or chronic health conditions may befall them.

#2 Lower Premiums

#3 Coverage From A Young Age

Related Articles

Why Do You Need Health Insurance For Newborns

Your precious one cannot be covered under your individual health insurance policy as its meant to only cover a single individual. So, during the birth of your little one, the last thing on your mind should be the increasing healthcare costs. However, insurance providers in India offer health insurance for infants under the family health insurance plan.

With medical insurance for infants, any expenses arising from hospitalisation, vaccination or other medical requirements are covered by the insurer. So, you can rest assured when it comes to your child and enjoy spending time with them instead of being concerned about your finances.

Recommended Reading: How To Help Newborn Fall Asleep