Does My Individual Or Family Plan Automatically Cover My New Baby

After your baby is born, your child is covered for the first 30 days of life as an extension of you, the mother, under your policy and deductible.

Starting on day 31, this extension of coverages ends. While maternity care and some health care services for children are essential benefits that are covered by all marketplace plans, health insurance for babies is not included as an essential benefit. To get health insurance at this time, you must enroll in or change your health insurance plan.

Having a child is a qualifying life event that triggers a special enrollment period. During the special enrollment period, you can enroll in a plan or change your current plan without waiting for the open enrollment period to begin. The special enrollment period extends for 60 days after your childs birth. Once enrolled, the effective date is retroactive to your childs birthdate.

When Can I Start Using My Insurance

Once you’ve signed up for a plan and paid the first month’s premium, you or your child can start using the insurance. The insurance company should send you and everyone covered by your policy insurance cards with your policy number and other information. If you or your child need to see a doctor or go to a hospital before you receive your card, call your insurance company first to make sure your family has been entered into their system.

You should also make sure that any doctor you choose for you or your child is in your insurance plan’s network. A network is made up of doctors, specialists, and other health care providers who have agreed to work with your insurance company when it comes to payments and services. If you take your child to a doctor who isn’t in your plan’s network, you may have to pay full price for some services.

Ask around and learn what you can about the primary care physicians in your plan’s network, and then choose a doctor you like. Once you’ve done that, schedule checkups and use your insurance to help keep your family healthy.

How Do You Sign Up A New Baby For Health Insurance

Benefits & Healthcare 4 min read time

HR professionals at organizations that employ new parents may find themselves fielding near-countless questions related to benefits and health insurance for their bundle of joy. From how to sign up a new baby for health insurance to questions about qualifying events, keep your employees informed with this handy guide to newborns.

Read Also: How Much Formula Should I Give My Newborn

Why Is Health Insurance With Newborn Cover Essential

Nowadays, medical treatment results in enormous expenditures for a family, and the costs are continuing to rise. Therefore, Keeping oneself secured financially with the help of a family health cover is a move in the right direction since medical emergencies can unexpectedly drain out our savings.

Children and newborn babies require the same protection as other family members. Thus, getting health insurance for children, including a newborn, is crucial, and it is possible by opting for the best family floater policy. This way, all the individuals of a family are covered under a single policy, and it ensures an affordable premium to a great extent.

Your Protections Under The Health Insurance Portability And Accountability Act

If you are eligible but not enrolled in an employers health plan, you may enroll yourself, your spouse, and your new child upon the birth, adoption, or placement for adoption of a new child. This is referred to as special enrollment.

Special enrollment is available regardless of whether the employer offers open season, or when the next open season might otherwise be.

To be eligible, you must request special enrollment in the plan within 30 days of birth, adoption, or placement for adoption. Check with your plan administrator, or check your plans summary plan description to find out if the plan has special procedures for requesting special enrollment.

Coverage for special enrollees is effective retroactive to the date of birth, adoption, or placement for adoption.

Special enrollees must be treated the same as similarly situated individuals who enrolled when first eligible. They cannot be treated as late enrollees therefore, the maximum preexisting condition exclusion that can be imposed on a special enrollee is 12 months, reduced by prior creditable coverage.

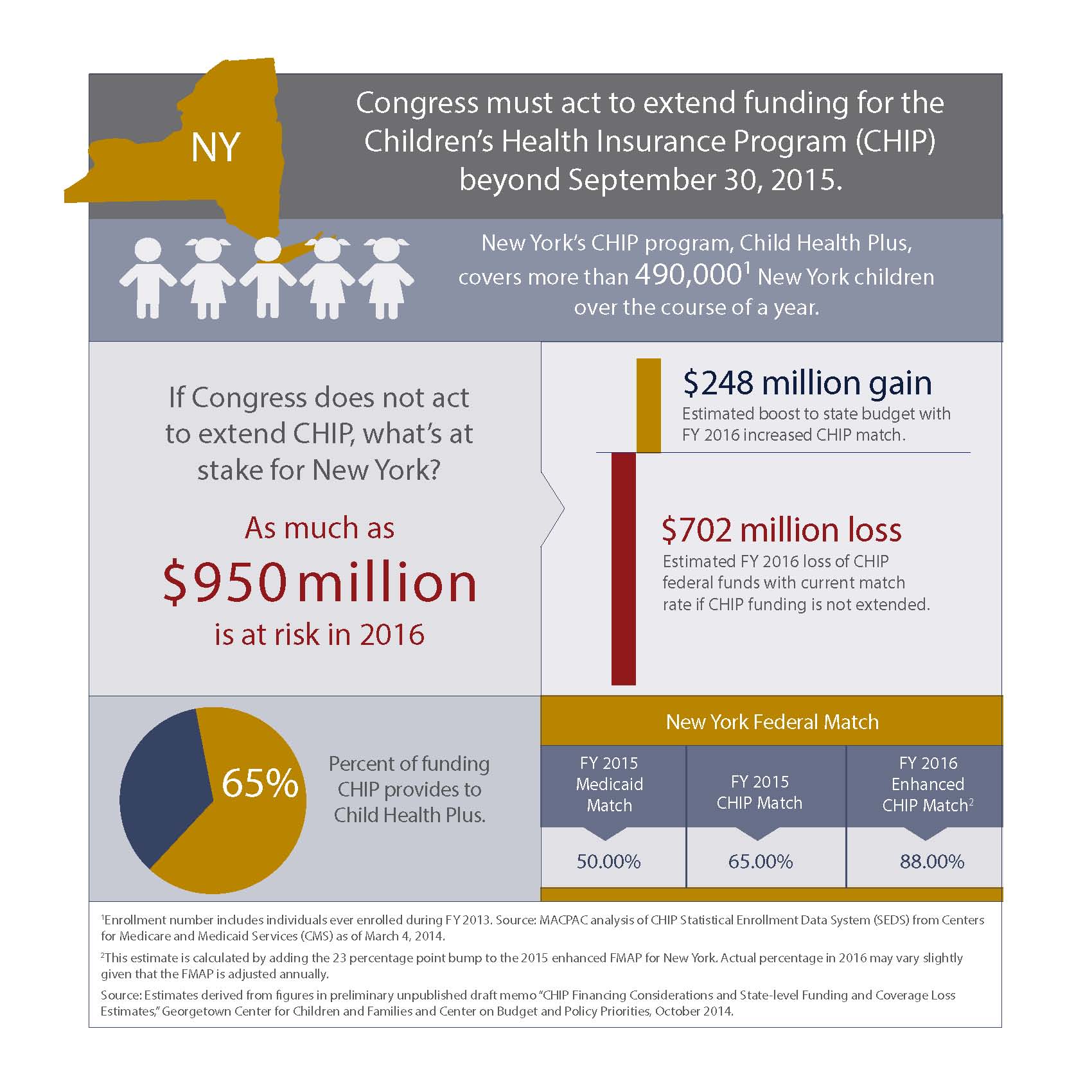

Most health coverage is creditable coverage, including most coverage under a group health plan , group or individual health insurance coverage, Medicare, Medicaid, TRICARE, Indian Health Service, state risk pools, Federal Employees Health Benefit Plan, public health plans, Peace Corps plans, and State Childrens Health Insurance Programs.

Read Also: How Are Newborn Babies Supposed To Sleep

What To Look For When Choosing A Policy

The important words to remember when shopping for a policy are “premium” and “deductible.” The premium is the amount you pay each month for coverage. The deductible is the amount you need to pay each year for medical services before your health insurance kicks in. As a general rule, insurance plans with low premiums have high deductibles, and plans with high premiums have low deductibles.

These are the basic levels of coverage:

- Catastrophic insurance is designed to protect an otherwise healthy person in the event of a major injury or illness. It’s available only to people under age 30 and those who are exempt from other plans due to hardship. This type of insurance can have low premiums but very high deductibles. Plans generally cover less than 60% of the costs of health care.

- Bronze plans also have low premiums and high deductibles, but they offer better coverage than catastrophic insurance, typically paying for 60% of costs.

- Silver plans and gold plans have average-sized premiums and average-sized deductibles. Silver plans cover 70% of costs. Gold plans pay 80% of costs.

- Platinum plans, the highest level of coverage, have high premiums and low deductibles. These plans cover 90% or more of health care costs.

Do I Need To Do Anything To My Insurance Before My Baby Is Born

Whenever youre going to get health insurance for kids, its important to compare policies because adding your child to your current plant isnt always the cheapest, and it might not provide adequate benefits. Therefore, make sure you see how much it would be to add your child to your policy. You may also create a child-only health insurance policy through another company without having to put yourself on the plan.

Understanding a few tidbits of information about insurance for newborns or adding a newborn to your current policy can help you make a financially sound decision about your little ones healthcare.

You May Like: How To Get Newborn To Sleep

Shots Are Important To Your Baby’s Good Health

They protect your baby from 10 diseases: measles, mumps, rubella, polio, Haemophilus influenza type b , hepatitis B, diphtheria, tetanus, pertussis and varicella .

To keep your baby healthy:

- Make sure you bring your baby for regular check-ups â from the time your baby is born. The first shot your baby should get is the hepatitis B vaccine. Your baby should get a first shot at birth, and “booster shots” in the first few months of life.

- Other shots will begin at two months of age. Your child will get shots until his or her second birthday.

- Booster doses of some vaccines must be given to your child before starting kindergarten.

- Bring your baby’s immunization record card to every check-up. Keep the card up to date. Make sure the doctor or nurse fills it out each time your baby gets a shot. You will need this information for your baby to go to day care or school.

Can Babies Be Covered By Health Insurance Before Theyre Born

No, but babies are covered retroactively for the first 30 days after birth as long as the child is enrolled in health insurance during this timeframe. This includes checkups, tests, and other medical procedures.

Additionally, the newborn will have their own deductible, coinsurance, and out-of-pocket maximum.

Don’t Miss: How To Add A Newborn To Medicaid

Health Insurance For Infants: Before And During Delivery

Luckily, your health insurance has you covered from the moment you discover youre pregnant. Prenatal care is considered a preventative service, which your insurer will pay for even before you meet your deductible. This includes things like ultrasounds, chorionic villus sampling , and amniocentesis, which serve to monitor your babys health and alert you to any issues well before delivery day.

When the day finally arrives, youre still covered: maternity and newborn care are one of the ten essential benefits all Marketplace plans are required to offer by federal law. If you are uninsured and do not qualify for a Special Enrollment Period, you may qualify for Medicaid under state law. Insurers also cannot reject your enrollment due to pregnancy, though you are still limited to applying during the Open Enrollment Period in most cases.

Be aware that you may need to pay a deductible before your insurance covers maternity services fully.

Best Health Insurance Plans For Newborn Babies

For the well-being of a newborn, health insurance is a must for all parents. Rising medical costs can dent a person’s financial status, leaving them with debt. Health insurance can take care of the newborn babys healthcare requirements. Health insurance provides wide-ranging benefits, including hospitalisation due to illness or injury, child vaccination, and clinical checkups.

At ACKO, we take care of in-patient hospitalisation and daycare expenses incurred towards the hospitalisation of the newborn baby born during the coverage period. The coverage is up to the sum insured stated in the policy and the applicable terms and conditions.

Recommended Reading: How Often Do Newborns Need A Bath

Factors To Consider When Buying Health Insurance Plans For Newborn

With many health insurance companies in the market offering newborn baby health insurance cover, it might be a tedious task to choose the most relevant one. To simplify the process, here are the important points which must be considered when purchasing a health insurance plan for a newborn baby.

1. Upgrading Feature: Most health insurance plans for newborn babies allow the parents to upgrade the plan coverage once the newborn completes 90 days. So, before buying a plan, one must make opt for the one that allows upgrading.

2. Premium: It is important to check the premium when buying a health insurance policy for newborn to ensure that it falls within the budget. Also, there are some health insurance plans that ask for an extra premium to cover the newborn baby while others do not. So, one should check the same before zeroing down any policy.

3. Plan Coverage: Newborn health insurance plans differ in their coverage features. Vaccination, prenatal and postnatal expenses are covered by some insurers, whereas others do not. To ensure that the newborn is always protected, choose a policy with maximum coverage features.

4. Co-Payment Clause: Some health insurance plans for newborn babies come with a co-payment clause wherein the parents are required to pay some amount from their own pocket at the time of claim. But health insurance plans with co-payment features come at a lesser premium comparatively. So, one should check the clause, if any, before buying the policy.

If You Have An Employer

If you have insurance through an employer, your baby will be automatically covered for a set period immediately after birth. Notify your insurer, or your human resources or benefits department, within 30 days of the babys arrival to add them onto the insurance plan.

Your baby will be enrolled retroactively as of their birth date and cant be rejected for preexisting conditions. Any medical care they get in those early days will be covered if you sign up in time, even for services received before you signed up.

Some employers offer extra time to enroll a newborn. Check your companys rules.

If you and/or your dependents are covered under Medicaid or a state Child Health Insurance Program but lose eligibility for that coverage, you have up to 60 days from the date you lose coverage to enroll in your employers plan.

During the Covid-19 pandemic, the U.S. Department of Labor and the Internal Revenue Service published a rule1 waiving certain timeframes, such as the deadlines for enrolling a newborn on a group health insurance plan. The rule will last until 60 days after the national public health emergency ends, or until a date determined by federal agencies.

The pandemic conditions are ever-changing, so check the current rules. That way, you know how long you have to add your baby to your health plan.

Also Check: How Can I Make My Newborn Poop

Do Babies Need Private Health Insurance

Although private health insurance for babies isnt a necessity, it can be a smart long-term investment for you and your family. Family health insurance policies can be tailor-made to suit your children as they grow from newborns into young adults. No matter what unexpected medical emergencies and events may arise in your childs life, having private health insurance means youll have the essential financial protection you need.

Parents Dont Have Health Insurance

If the mother and father of a newborn do not have health insurance, then all expenses must be paid out of pocket. A recent study found the average price tag for vaginal deliveries and c-sections in California fall between $15,000 and $45,000. Thats a huge financial burden for new parents to take on. If that isnt enough of a reason for you to get health insurance before your newborn arrives, the possibility of putting the babys health at risk should be.

Although newborn babies are covered under their mothers health insurance policy for the first 30 days, not every mother has health insurance. In this case, babies whose mothers do not have health insurance are not covered. Complications that arise during birth or shortly after will continue to add to the financial burden.

Even without complications, there are several essential doctors appointments during the first 18 months of a childs life. These office visits are considered preventative care and are covered if you have health insurance. Without it, you either skip the appointments, which can be detrimental to your childs development and health, or you pay for all of those appointments out of pocket. Not having insurance for a newborn is significantly more expensive than it is for an adult.

Also Check: How Hot Should Newborn Bath Be

How Parents Can Switch Health Plans After The Birth Of A Newborn

In addition to making changes to their existing benefits plan, a qualifying event also permits parents to switch health plans entirely during the SEP. For example, a married couple who just had a baby may decide to move from the health insurance plan provided by one persons employer to the plan provided by the other persons employer.

Having a child is expensive. Employees may inquire about costs during this process, especially if theyre choosing between their current health plan and an alternative.

As HR, it can be helpful to ask employees the following questions to help them make their decision:

Types Of Health Insurance Policies For Newborn Babies In India

In India, there isnt a specific or newborn health insurance plan. Also, the regular Individual Health Insurance Plan does not cover dependents hence, newborn babies are not covered.

It is better to opt for the Family Floater Health Insurance Plan to cover newborn babies, or you could opt for the Maternity Health Insurance Plan. These are the primary types of health insurance plans for newborns.

Read Also: How To Avoid Colic In Newborn

Health Insurance Portability And Accountability Act

The Health Insurance Portability and Accountability Act is often referenced in regard to patient privacy. But, did you know that HIPAA also offers protection to mothers and newborns?

Under the law, if you have health insurance coverage when you give birth, your child is automatically covered under your insurance for the first 30 days of their life.

This gives you time to make a decision about your childs coverage, without having to worry about incurring expensive bills due to a medical emergency.

Several Factors To Keep In Mind While Buying A Health Insurance Policy With New Born Baby Cover

While opting for the newborn baby cover, you need to keep in mind certain factors that may affect your health insurance policy and its premium. Here are the mentions of those, below.

Age of the Child The children who are of the age 90 days or more, can be included under the family floater plan of their parents. This will cover the expenses of early vaccinations and post-natal care. However, some insurers offer this care from day 1. So, before opting for this benefit, you need to be thorough through the policy wordings.

Intimate The Insurer You need to inform your insurer about the birth of your child prior to it. The benefit can either start to give coverage immediately after the birth of your child or when they get 90 days old. So, intimating the insurer is an important responsibility on your behalf.

Necessary Documentation To facilitate the benefit, you need to submit the required documents to the company such as the birth certificate of the child, the discharge certificate from the hospital, etc.

Check The Premium As nothing comes free of cost, you need to pay a little extra premium to avail of this new baby cover benefit. So, before opting for any policy with this cover, check and compare the premiums you need to pay towards your health insurance plan. Only then, go for the most suitable one.

Read Also: How Does Newborn Hearing Test Work