What Is The Child Tax Credit Income Limits For 2022

For the 2021 Child Tax Credit claimed as part of 2022 tax returns, the credit is maximized for single filers making less than $75,000, heads of household making less than $112,500, and married filing jointly filers earning less than $150,000. These figures are based on the filer’s modified adjusted gross income.

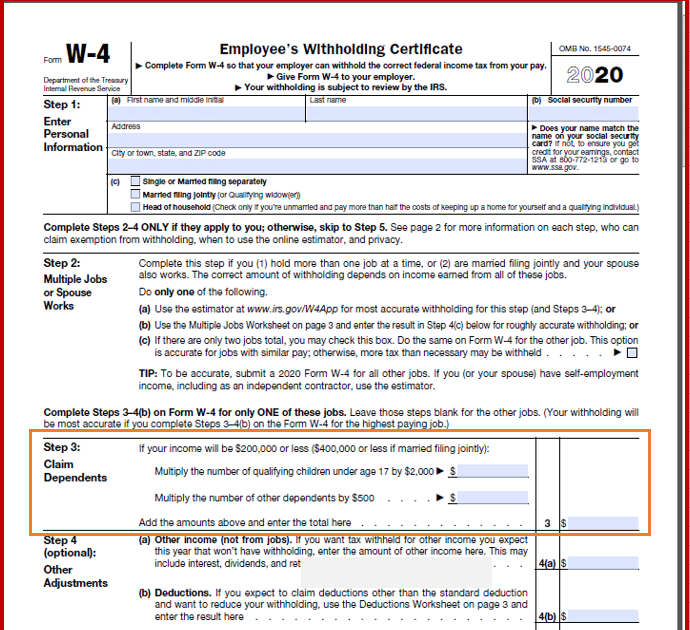

There are two phaseout limits for the Child Tax Credit. The first phaseout limits the Child Tax Credit amount for every $1,000 of modified adjusted gross income the taxpayer exceeds the amounts above. The first phaseout stops when the credit is reduced to $2,000 per qualifying child.

The second phaseout enacts the same reduction practice starting at $400,000 for married couples filing joint returns and $200,000 for all other filing statuses.

Information You Share With Irs

Signing up to receive Child Tax Credit payments, or filing a 2021 tax return, does not mean information about you or your family will be shared with immigration enforcement. Taxpayer confidentiality laws prevent Internal Revenue Service employees, except in very limited circumstances, from legally sharing information with other federal agencies. It can be a crime for an IRS employee to improperly share taxpayer information with immigration enforcement.

Consequences Of A Ctc

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

-

You must pay back any CTC amount youve been paid in error, plus interest.

-

You might need to file Form 8862, “Information To Claim Certain Credits After Disallowance,” before you can claim the CTC again.

-

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

Recommended Reading: How Many Ounces Of Formula Should A Newborn Eat

Families Are Eligible For Remaining Child Tax Credit Payments In 2022

If families get a letter from the IRS saying how much they received from the advance CTC, they should keep the letter because it will have important information for filing their 2022 return. The IRS will send Letter 6419 to all families who received the advance CTC payments indicating how many monthly CTC payments they received and how many children in the household were eligible. The IRS will mail the letter to the address it has on file for the family. Families can also log on to the IRS CTC Update portal to look up this information. If the number of the total CTC payments the parent enters on the 2021 tax return doesnt match what the IRS has on file, this may delay their refund.

Parents or caregivers can receive the portion of the 2021 CTC they have not received by filing IRS Tax Form 1040 or 1040-SR or by using the GetCTC tool. There are several free ways to file taxes online or to receive in-person support from community partners when filing a return. If they got an IRS Letter 6419, they should bring it with them if they are getting in-person help. Some options for tax assistance include:

Child Tax Credit: Impact On Policy And Poverty

The expansion of the Child Tax Credit for 2021 has important policy and economic implications. When the Child Tax Credit was first enacted, it was intended to benefit low- and moderate-income families. Since its enactment in 1997, it has benefited these taxpayers. At higher income levels, the credit is phased out gradually. However, the Child Tax Credit had been criticized regularly for providing little or no benefit to the poorest families, many of whom are not taxpayers and do not file tax returns.

Over the years, frequent amendments increased the Child Tax Credit amount and provided refunds that were limited in amount and scope at one time, refunds were restricted to taxpayers with three or more children. High-income phaseouts continued, and credit disallowance rules addressed fraudulent, reckless, or improper claims. But, for years, the Child Tax Credit did not reach the poorest families.

In 2021, for the first time, the significant increase in the credit amount and the provision of total refundability extended benefits to the neediest families. According to the Center on Poverty & Social Policy at Columbia University, “…the sixth Child Tax Credit payment kept 3.7 million children from poverty in December . On its own, the Child Tax Credit reduced monthly child poverty by close to 30%.”

Recommended Reading: How To Make Your Newborn Sleep Through The Night

Do Advance Payments Count As Income Do I Need To Report It On My Tax Return

No. Advance payments are not income and do not need to be reported as income on your tax return. These payments were early payments of your 2021 Child Tax Credit, which you would normally claim as part of your tax refund when you file your tax return. Even though the advance payments dont need to be reported on your tax return, in January 2022, the IRS sent you Letter 6419 that tells you the total amount of advance payments sent to you in 2021. Please keep this letter for your tax records. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC. You can either use Letter 6419 or your IRS account. Learn more about Letter 6419.

Can I Claim My Newborn On My Taxes Burning Question For New Parents

Overall, 2021 was a good year to bring a new baby into the world. As the year draws to a close, you might wonder if you can claim your newborn on your taxes in 2022.

The answer is yes. You can claim your newborn as a dependent on your 2021 tax return if the child was born before 11:59 p.m. ET on Dec. 31. If your baby is born even a minute after you ring in the new year, youll have to wait until 2023 to claim the baby on your 2022 taxes.

Also Check: How To Buy Diapers For Newborn

Can I Claim Child Tax Credit For A Baby Born In 2021

DEPENDING on the status of the stimulus relief program, there’s a chance that new parents can claim their newborn baby for their 2022 tax refund.

For parents and guardians to claim their newborn babies that were welcomed in 2021, the United States Senate has to make a decision on the stimulus relief program.

Children Born Or Newly Added To Your Family In 2021

Last years monthly Child Tax Credit payments were based on your 2019 or 2020 tax returns, which did not include any children born or newly added to your family in 2021.

However, a child born or added to your family in 2021 can be a qualifying child for the full 2021 Child Tax Credit, even if you did not receive monthly Child Tax Credit payments in 2021. You will receive the full amount of the Child Tax Credit that you are eligible for when you file your 2021 tax return.

Recommended Reading: What Do I Need For Winter Newborn

Who Qualifies For The $1400 Stimulus Check This Year

Soon after the passage of the most recent stimulus package in March, the IRS sent out millions of $1,400 stimulus checks. But payments for dependents born in 2021 won’t come until the 2021 tax season .

As with the child tax credit, parents can qualify for the stimulus payment if they fall under certain income cutoffs. Single filers making up to $75,000 per year in adjusted gross income could qualify for the whole $1,400 check for their dependent, while couples filing together making up to $150,000 could also get the full amount. Above those levels, payments phase out, with cutoffs at $80,000 for single filers and $160,000 for couples. Parents can receive the check by claiming the Recovery Rebate Credit on their 2021 tax returns next year, says H& R Block’s Phillips, just like they did on their 2020 tax returns if they were owed more than they received in stimulus payments last year.

What If I Filed A 2020 Tax Return But The Irs Still Hasnt Processed My 2020 Tax Return

The IRS used your 2019 tax return to determine if you were eligible for advance payments and if you were, the amount you qualified for. Once your 2020 tax return wasprocessed, your payment amount may have changed.

Because of the IRS delay on processing tax returns, your advance payments may not have been adjusted in time. You will need to file a 2021 tax return to receive any missing money that you are owed.

Recommended Reading: How To Latch A Newborn Baby

Tax Credits Every New Parent Should Know About

Congratulations on your new baby! During this exciting time, taxes are probably the last thing on your mind. Just so you dont lose precious sleep over tax breaks you may be missing , weve rounded up the 9 credits and deductions created to help support your growing family.

Key Takeaways

A $5000 Baby Bonus Heres What Tax Credits Await Parents With Kids Born This Year

Parents who welcome a new child into their family this year could also find themselves expecting a different bundle of joy: a heftier 2021 tax refund.

That’s because parents, if they meet the eligibility requirements, could qualify for up to $5,000 per child born in the 2021 calendar year, through two tax credits included or expanded in the $1.9 trillion aid package signed into law by President Biden in March.

According to Andy Phillips, director at the Tax Institute at H& R Block, parents could qualify for up to $5,000 between a newly enhanced child tax credit and a stimulus check for dependents . For both the expanded child tax credit and the stimulus check, eligible parents would qualify so long as their newborn arrives before the end of the year. For most families the $1,400 stimulus checks have already been sent out, but because the checks are technically an advance of a 2021 tax credit, eligible parents can get the payment for their 2021 newborns when they file taxes next year. A Democratic aide confirmed these details to Fortune soon after the passage of the stimulus package.

For both credits, parents would have to claim the 2021 newborn as a dependent when it comes time to file their 2021 taxes next year. To better help parents understand the credits, Fortune created a guide to what may be in store for them come next tax season.

Recommended Reading: How To Give First Bath To Newborn Baby

Child Disability Credit & Disability Amount

If your child is born with, or develops a disability, you may be eligible for an additional credit on your tax return as well as an extra benefit added to your Canada Child Benefit. To set the wheels in motion, your childs doctor or nurse practitioner should completethis formand forward it to the CRA. If approved, youll be eligible to claim the disability amount for your child at tax time. If you already receive CCB payments, an extra amount will be added.

Quebec residents can apply fora provincial credit as outlined in thisguide.

Tax Year 2021/filing Season 2022 Child Tax Credit Frequently Asked Questions Topic B: Eligibility Rules For Claiming The 2021 Child Tax Credit On A 2021 Tax Return

A1. You qualify for the Child Tax Credit if:

- You have a qualifying child, as described in Q B2

- Your qualifying child has a Social Security number that is valid for employment, as described in Q B9 and

Q B2. Who is a qualifying child for purposes of the Child Tax Credit?

A2. For tax year 2021, a qualifying child is an individual who did not turn 18 before January 1, 2022, and who satisfies the following conditions:

A8. No.

Recommended Reading: What Pacifier To Use For Newborn

Why Life Changes Affect Child Tax Credit Payments

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Changes in income, filing status, the birth or death of a child, or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax return.

This section will help you understand how certain life events will impact your Child Tax Credit eligibility.

Even After November Deadline You Can Claim Credits

The November deadline is just to use the simple GetCTC.org tool. To be sure, those who are eligible for the child tax credit can still claim the money for up to three years after the initial due date, Zucker noted.

But in order to do so, you’ll have to go through a few more steps. A key to-do: Filing tax returns for the years in question.

“Now is the time to do it,” Zucker said, noting it will only take most families about 15 minutes to use the simplified service.

Even families who received the monthly child tax credit payments may not realize they need to file to get the rest of the money they are eligible for, said Roxy Caines, campaign director at Get It Back, which is working to help individuals and families claim tax credits.

If there’s any doubt or question in someone’s mind, they should check it out because they could still be eligible and have this money available.Roxy Cainescampaign director at Get It Back

“Even if you got advance payments, you have to file a tax return to get your remaining tax credit,” Caines said.

Resources such as United Way’s MyFreeTaxes.com and the IRS’ Volunteer Income Tax Assistance Program may assist people who need help navigating the tax-filing process. To qualify for assistance, income restrictions apply.

Some may hesitate to claim the credits because of fears it could interfere with other public assistance, like food or housing, Caines said. However, the credits were designed not to limit those other forms of aid, she said.

You May Like: How To Comfort A Newborn

How To Determine Whether A Child Qualifies

Most children under the age of 18 are qualifying children for the 2021 Child Tax Credit. This means that a parent or guardian is eligible to claim them for purposes of the Child Tax Credit.

For your children to qualify you for a Child Tax Credit, they must:

The IRS has provided detailed information on other, less common factors that may impact whether a child is a qualifying child for the Child Tax Credit.

If The Parents Are Undocumented Immigrants How Can They Receive The Child Tax Credit Advance

If a family has at least one qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number they may receive the advance Child Tax Credit, regardless of the immigration documentation status of the parents.

For more information about how to qualify for the credit and prepayments, how to register to receive prepayment, or how to opt-out of receiving prepayments, you can visit the IRS website at or the GetCTC website at or .

Also Check: How Long To Let Newborn Cry

Stimulus Impact On The Child Tax Credit For 2021 Only

New, Temporary Advance Child Tax Credit Payments

The Child Tax Credit was expanded by the American Rescue Plan Act, that was enacted in March of 2021. Part of this expansion was to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them wait until they prepare their 2021 tax return in 2022. Most families do not need to do anything to get their advance payment. Normally, the IRS will calculate the payment amount based on your 2020 tax return. Eligible families will receive advance payments, either by direct deposit or check.

The amount that you receive will be reconciled to the amount that you are eligible for when you prepare your 2021. Most families will receive about one-half of their tax credit through the advance payments and the other half through their tax return. If you receive too little through the advance payments, you can claim an additional amount on your tax return. In the unlikely event that you receive too much, you might have to pay the excess back, depending on your income level.

Child Tax Credit Changes

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to $3,600 for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17.

In addition, the entire credit is fully refundable for 2021. This means that eligible families can get it, even if they owe no federal income tax.