If You Currently Have Marketplace Coverage

- If you want to keep your current Marketplace coverage, dont report your pregnancy to the Marketplace. When filling out your application for Marketplace coverage, select the Learn more link when we ask if youre pregnant to read tips to help you best answer this question.

- If you report your pregnancy, you may be found eligible for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program . If you are found eligible for Medicaid or CHIP, your information will be sent to the state agency, and you will not be given the option to keep your Marketplace plan.

- If you keep your Marketplace coverage, be sure to update the application after you give birth to add the baby to the plan or enroll them in coverage through Medicaid or CHIP, if they qualify.

How Much Youll Pay To Have A Baby

The amount you will pay out of pocket for the costs of childbirth will depend largely on whether or not you have health insurance, and if you do, on the cost-sharing structure of the plan you choose. If you do have health insurance, you may have to pay your deductible towards your inpatient care when you deliver your baby. You could also have copays or coinsurance towards things like medications, physician services or radiology.

Lets use an example to illustrate total out of pocket costs for a mom-to-be with health insurance coverage. A 32-year-old woman and man in Wayne County, Michigan, got married and planned to have a baby in 2015. Their marriage was a qualifying life event for enrolling in an insurance plan on MI’s health insurance exchange, so they started looking at their options. She called her obstetrician and the hospital where she planned to deliver and learned they were both in-network with the UnitedHealthcare plans on the exchange, so they only considered those.

Sample Patient Costs with Deductibles and Coinsurance

The chart below shows various scenarios assuming different United HealthCare plan options for the couple. We’ve assumed they live in Livonia , and for simplicity, have only shown healthcare costs just for the expectant mother. Patient costs assume deductibles, copays, coinsurance as well as any limits or exclusions for the mother:

| Example Patient’s Plan | |

|---|---|

| 1,100 | 7,466 |

Questions to Ask Your Health Insurance Provider

The Benefits Of Life Insurance For Children

Now that youre a new parent, you should consider child life insurance. Life insurance can give your child an invaluable head start. If offers many of the same benefits as regular whole life insurance, but with lower premiums. The benefits include:

- Lifetime protectionA life insurance policy purchased for your child can provide death benefit protection into adulthood.

- Cash value that growsA childs life insurance policy can accumulate cash every year that your child can access it for future purchases and expenses, such as college tuition, a down payment on a home, or retirement. Accessing cash value will reduce the death benefit and available cash surrender value.

- Tax advantagesCash value accumulates tax-deferred and can be accessed generally income tax free, if structured properly.

- Low premiums With this type of permanent life insurance, its possible to lock in the premium at the childs current age for life.

- Guaranteed future insurability Once the policy has been issued, coverage cannot be canceled if all required premiums are paid.

Having a baby can be an amazing journey filled with excitement and wonder. While variables around geography, childcare needs, and insurance coverage may impact how much you spend on your child, there are clear advantages to working with a New York Life agent early on to develop a financial strategy for your child.

Read Also: How Many Ounces Do Newborns Drink Per Feeding

Additional Tips To Save On The Cost Of Giving Birth

Tip 1. Get tax savings on health-related expenses.Enroll in a health savings account or flex spending account if you qualify, both of which allow you to save on taxes for the expenses you pay out of pocket.

Tip 2. Understand your insurance plans benefits.Know what is and isnt covered, decide how important it is to get the things that arent covered, and know what things you can get without having to pay extra for it .

Tip 3. Make sure doctors and specialists are in your provider network.Most insurance plans charge two different prices, depending on if your doctor or specialist is part of their preferred network. The price difference is pretty big, so be prepared if you are choosing a doctor from outside the network.

Tip 4. Try your best to stay healthy.Virtually all services rendered will include copays, deductibles, and other costs. While you cant guarantee there wont be any complications, whatever you can do to keep them as few as possible will be better for you, the baby, and your wallet.

Please Save or Share this Post:

Health Insurance For Newborn Babies

BY Anna Porretta Updated on December 16, 2021

When you are expecting a child, there are many things that might be on your mind during your pregnancy. One of those concerns could be healthcare coverage for your baby. Fortunately, this is one concern you may put to rest.

If you have your own healthcare plan, you andyour child will have coverage immediately following birth. If you or yourspouse have health insurance through an employer, you will be able to changeyour plan right away, since having a child is a qualifying life event thattriggers a special enrollment period. That special enrollment period alsoallows you to enroll in a plan to get the coverage you and your baby need.

If you are looking to find a family health insurance plan or need help figuring out which type of health plan is right for you, eHealth is here for you. Compare affordable plans in your area with out comparison tool or speak to a licensed agent online or over the phone today.

You May Like: How Much Food Should Newborns Eat

Should You Buy Whole Life Insurance For Children

Some professionals say yes, you should, and some say no, you shouldnt.

Heres the truth.

Its entirely up to you! If you sleep better knowing your children/grandchildren are insured, then buy them a policy. If not, then dont.

Again, its totally up to you.

Insurance provides peace of mind. The question is, do you feel the peace of mind is worth the few bucks youll spend to get whole life insurance for your kids.

Only you can answer that.

Getting Ready For A New Arrival Understanding Health Insurance For Your Growing Family

Whether youâre expecting a baby, adopting, or fostering a child, hereâs how to make sure your newest addition is covered from day one.

Even lifeâs most joyous events come with responsibilities â maybe none more so than preparing for the arrival of a new family member. Whether you are an adoptive parent, a first-time mom or a veteran foster dad, your childâs wellbeing will be your top concern. Once you bring your child home, youâll want to give them all of your attention, so take the time now to look into health coverage options for your growing family.

Todayâs the Day

However long youâve waited for your child, you wonât have to wait for health insurance. Through Covered California, you can add or change coverage as soon as your little one arrives.

Covered California is a free service that helps connect California residents with brand-name health insurance as well as financial and enrollment help for those who need it. Usually, you can only purchase health insurance through Covered California during the yearly sign-up period known as open enrollment. Certain exceptions are granted for life-changing events â and for good reason, having a new child qualifies.

Safeguard Your Family

Keep Your Paperwork Handy

Also Check: How To Add Newborn To Insurance Blue Cross Blue Shield

Make Sure The Nest Is Really Empty

Donât discount the life insurance safety net youâll need until youâre sure your nest is absolutely empty. Itâs not uncommon for kids to move back home after they graduate college, so that can add some unexpected expenses to your budget.

You might also have other, non-child dependents who rely on you and your income at this point in your life â namely, aging parents or other elderly relatives. Though their own long-term care insurance can help cover the costs, if you are supplementing that with your own money, you need to factor those expenses into your life insurance calculations.

How Do I Find Life Insurance

Most people buy life insurance through their employer. In some cases, you can buy insurance for both yourself and your spouse through your employer. You can also buy life insurance through an insurance agent, through a professional organization you belong to, or a civic organization. Veterans may be able to buy life insurance through the VAs life insurance program.

As you consider where to buy your life insurance, here are a few things to keep in mind:

- Check that the insurance company is licensed and is covered by your states guaranty fund. This ensures that your state will cover your benefit should the insurance company go out of business or default.

- Research the companys complaints, and obtain their credit ratings.

- Read reviews from customers and ask friends and family members for personal reviews.

- Read your insurance companys entire policy and make sure you understand all the terms of the policy. You should receive the policy within 60 days of signing up.

- Trust your gut: if the companys policies and rates seem too good to be true, they probably are.

You May Like: How Often Do You Bathe A Newborn

Ontarios Routine Immunization Schedule Tool

This immunization tool will help you learn about Ontarios free vaccine program, and make it easy to keep your family up to date with the recommended vaccinations.

For more information on registering a birth with multiple parents, with a surrogacy agreement, or parents using inclusive titles, please call us at

What Do You Need To Do Before Your Baby Is Born

While youre preparing for your baby to arrive, review the costs and benefits of your current health insurance and compare them to other plans and options . If you find a better option, reach out to the new insurer to make the switch after your baby is born.

If you have other children, it may not cost you more to add the newborn.

Required Benefits

Maternity and newborn care are part of the essential health benefits required by the Affordable Care Act.

Also Check: How Long To Use Newborn Diapers

Life Insurance For New And Expecting Parents

For new parents, as for anyone buying life insurance, the question is: If you were to die today, how much money would you need to leave behind to keep your dependents going?

This includes day-to-day living expenses like diapers, toys, food, formula, and clothes, plus larger bills, too â childcare, health insurance, summer camp, and school tuition, if you plan on sending your kids to private schools. The USDA estimates that it costs nearly $250,000 over 18 years to raise a child, but your figure could be more or less than that.

And then thereâs college. If youâd like to protect your kids from student loan debt, the cost of college should be integrated into your life insurance policy.

And donât forget about your mortgage or rent payments. If you want your family to be able to stay in your home for the next few decades, factor housing costs into your life insurance needs.

If youâre planning for a baby, the best time to buy coverage is before you get pregnant .

Once youâre already pregnant, itâs best to either apply in your first trimester or wait until a few months after youâve delivered. The reason? Life insurance companies will set your rates based on your health at the time of application. That means weight gain and gestational diabetes will be taken into account, even though those symptoms may be temporary.

Ready to shop for life insurance?

Adding Your Baby To Your Health Insurance

As youve got insurance on your mind, you are probably also wondering how to add your baby to your health insurance. That, too, is something that it makes sense to consider while you are pregnant.

Heres a brief synopsis of what to know about that:

- You should reach out to your health insurance company before your baby is born to understand their protocols for adding your baby to your insurance.

- If you get health insurance through your job, you will need to contact your human resources department for more information about enrolling your child.

- After your babys birth, you will need to provide your babys birth certificate for them to be added to your insurance.

- Dont worryif your child needs medical attention before they are officially on your insurance, they will be covered, because as soon as their coverage starts, its retroactive to their birth.

Read Also: What Do You Really Need For A Newborn

Registered Education Savings Plan

A Registered Education Savings Plan is an education savings account that is registered with the Government of Canada. It helps you, your family or friends put aside money for your childs education after high school.

With an RESP, you may be able to receive other saving incentives, such as the:

Costs Of Life Insurance

Most of us who sign up for term life insurance find that the policies are actually much more affordable than we expect them to be. If you are under about 40 years old and are in good health, you are less likely to pay an amount that breaks the bank.

Most of us who buy life insurance find our premiums to be about between $100$550 per year, which amounts to a relatively small monthly fee.

Don’t Miss: How Long Newborn Baby Sleep

Find Cheap Health Insurance Quotes In Your Area

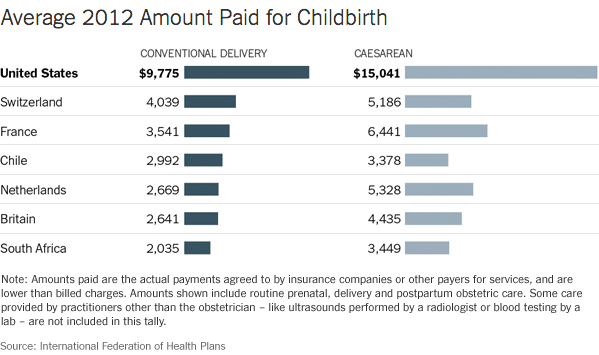

When youre pregnant, you may spend a lot of money on baby gear, and some on prenatal care, but your biggest bills will likely arrive shortly after the baby doesfor labor, delivery, and the medical care you and your newborn get when you give birth. Here we’ll cover the average cost of pregnancies – from both sticker price to allowable amounts under health insurance plans, show what types of services are included in the costs, and explain how health insurance plans cover deliveries.

Births Through Assisted Reproduction Surrogacy Or With Three Or Four Parents

Through the Childrens Law Reform Act, you may be recognized as a parent to a child in certain circumstances. For example, you may be recognized as a parent to a child:

- if the child is born to your spouse, where the child was conceived through assisted reproduction or insemination by sperm donor.

- if you are part of a pre-conception parentage agreement for that child that has no more than four parents in the agreement.

- where the child is born using a surrogate, if you had a surrogacy agreement before the child is conceived, and the surrogate agrees to give up parental rights no earlier than 7 days after the child is born.

You can register the birth online for all of the examples listed above.

If the birth involves a surrogate, make sure that you have the following forms completed, signed and commissioned before starting the online registration. You will need to mail them to the Office of the Registrar General to complete the registration.

Don’t Miss: How To Help Newborn Sleep Longer At Night