Dont Get Stuck Without Newborn Insurance Coverage In California

Neglecting to plan to get health insurance for your newborn will result in significant financial burdens. If a mother has a child without insurance in California, she could owe up to $45,000 for the delivery of her child alone. Even if both parents have insurance, failing to get a plan in place for their newborn to have coverage on day 31, after the 30 days of coverage as an extension of the mother, can result in paying an additional 20% more the entire first year as a penalty for not having coverage.

At Health for California, our goal is to make it easy for Californians to get the health insurance coverage they need for themselves and their newborn. Our website is focused on educating those who may not know much about health insurance, and to make it easy to find an affordable health insurance solution for mothers, fathers and children. Begin your new adventure as parents by requesting a free, no obligation quote on our website so you can be sure your newborn has the best health insurance plan from the moment they arrive.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

When Should I Give My Baby Vitamin K

A vitamin K shot can be administered after the first feeding at the breast, but not later than 6 hours of age. An oral dose of vitamin K is not recommended. Oral vitamin K is not consistently absorbed through the stomach and intestines, and it does not provide adequate amounts for the breastfed infant.

Your Protections Under The Newborns And Mothers Health Protection Act

If a group health plan, health insurance company, or health maintenance organization provides maternity benefits, it may not restrict benefits for a hospital stay in connection with childbirth to less than 48 hours following a vaginal delivery or 96 hours following a delivery by cesarean section.

You cannot be required to obtain preauthorization from your plan in order for your 48-hour or 96-hour stay to be covered.

The law allows you and your baby to be released earlier than these time periods only if the attending provider decides, after consulting with you, that you or your baby can be discharged earlier.

In any case, the attending provider cannot receive incentives or disincentives to discharge you or your child earlier than 48 hours .

If your state has a law that provides similar hospital stay protections and your plan offers coverage through an insurance policy or HMO, then you may be protected under state law rather than under the Newborns and Mothers Health Protection Act.

Also Check: How Much Breast Milk For A Newborn

What Is The Best Insurance Plan For Pregnancy

This is a very common question that comes to our mind while buying maternity insurance during pregnancy, and the answer to which varies from person to person.

There are mainly two types of maternity insurance during pregnancy, i.e., fully paid plans and co-payment plans. Under the first plan, an individual does not have to pay anything at all, whereas, under a co-payment plan, there is a certain percentage of the payment for your medical treatment and services.

It is wise to buy fully paid plans as they do not involve any risk at all, and you will be able to enjoy all the benefits without paying anything.

Care For Your Babys Smile Now

Dental care should begin soon after birth.Dentists recommend wiping your babys gums with a damp washcloth or soft infant toothbrush after meals. Once the first tooth erupts, start brushing gently with a soft, baby-sized toothbrush twice a day. Dentists also recommend that you schedule your childs first dental appointment by age 1.

As your baby gets bigger, teach good oral health habits. Simple preventive care, including brushing and flossing daily and regular dental visits, can help small smiles grow up healthy.

Also Check: How Much Should A Newborn Poop

Read Also: What Can I Do For A Constipated Newborn

Health Insurance For A New

You can never know when you might have to seek hospitalization for your new-born baby. Even thinking about such a situation is scary, but what is even scarier is to face such a situation without being prepared for it. The cost of medical care in present times is increasing every year, and any extended stay at a hospital can drain your savings in no time. This is why you must consider buying health insurance for your baby as soon as possible.

Presently, it is not possible to subscribe to individual health insurance for a baby you need to include the name of your baby in your existing family health insurance plan. You can therefore extend the coverage of your existing family floater plan or a group health insurance plan to provide the insurance coverage to your baby.

This will allow you to be relieved of any worries pertaining to the costs included with any unforeseen hospitalization after your baby has been born. Depending on the guidelines followed by the insurance company, the premium might increase slightly on the addition of the name of your baby to your existing policy. But, in order to be able to add the name of the baby to a health insurance policy, most insurance companies require the baby to have attained the age of 90 days. So, you must check the same with your health insurance company and include the name of your baby as soon as he/she is eligible for the health insurance coverage.

Read Also: How To Tell If A Newborn Is Deaf

Newborn Baby Health Insurance

Becoming parents is one of the most significant milestones for any couple. A new member is added to your family, which adds to the responsibility of many kinds. Buying the best child plan for newborn baby will stay with your child in times of emergency and it will keep your child hale and hearty. Creating a secure future for your child is one of the essential things parents must do, but some do not have enough knowledge about how to begin financial planning for their growing family and buy a new born baby health insurance.

A newborn baby of a minimum age of 91 days is eligible for health cover under a family floater health insurance.

You May Like: How Many Times Should I Bathe My Newborn

Is My Newborn Automatically Covered On My Health Plan

Newborns are automatically covered on the parents health plan for the first 30 days however, after this period is over, the parents will need to either enroll or modify their current health plan to include their newborn. Since childbirth is a qualifying event, you qualify for a special enrollment period up to 60days after your child is born.

Why Is It So Important To Ensure My Baby Is Covered By A Health Insurance Plan

Welcoming a child into the world can be one of the most exciting and rewarding parts of a persons life, but it can also be the most stressful. There are so many things to worry about when welcoming your little bundle of joy to the world, from setting up a nursery to buying new clothing. Then, in the midst of the happiness comes every mothers concern: what if something happens to the baby?

The thought of your newborn getting sick is one of the most terrifying things a parent can imagine, which is why making sure that your baby is insured is critical. This, of course, begs the question: when should I get health insurance for a newborn?

Read Also: How Much Should A Newborn Drink Of Formula

How Do You Get Insurance For A Newborn

You can compare health insurance options for your baby with HealthMarkets. HealthMarkets innovative FitScore® can help you review your options and find the insurance plan thats right for your needs and budget. Simply answer a few quick questions, and the FitScore can rank plans for you in a personalized list based on your responses. Compare plans with HealthMarkets today!

47335-HM-0421

Registering A Child Born In Qubec

If you or the other parent are already registered with the plan as residents or temporary residents of Québec, you dont have to register your child if he or she is born in Québec. All you need to do is register your child with the Directeur de létat civil, using the form obtained from the hospital or given to you by the midwife. The information needed for registering your child with the Health Insurance Plan and, where applicable, for the Public Prescription Drug Insurance Plan will be sent to RAMQ automatically. Thereafter, RAMQ will assess your childs eligibility.

If you or the other parent are not eligible for or registered with the Health Insurance Plan at the time RAMQ receives the information from the Directeur de létat civil to register your child, we will send you a letter asking you to contact us to assess your childs eligibility.

If your child is eligible, you will need to provide documents confirming you and your childs presence in Québec to complete registration for health insurance.

Recommended Reading: How To Use Ergobaby Omni 360 Newborn

You May Like: What Is The Best Formula For Newborns

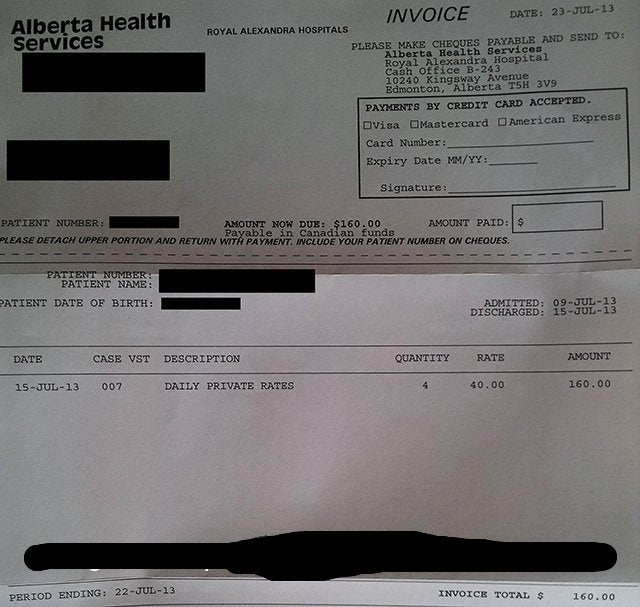

How Will We Be Billed

After your baby is born, the hospital costs and medical services for your baby will be billed separately from your costs. This means youll get two different/separate explanations of benefits and bills. One set for your services and one set for your babys services during your inpatient hospital stay.

Your babys medical expenses will be covered by health insurance once you add him/her to a health insurance plan. Dont worry, your babys coverage effective date is retroactive to his/her date of birth.

If you have any questions before or after your baby is born, call your member services. Theyll help you through the process and make sure you can enjoy your new bundle of joy.

What Are The Risks Of Not Having Newborn Coverage After The First 30 Days Of Birth

According to Medibank, health care services for newborns are among the most expensive medical expenses. According to Parents.com, birth can cost between $2,000-$4,500 dollars depending on the method of delivery without complications. You would not only have to pay for prenatal, delivery, and postnatal care out-of-pocket, but for all care that your newborn receives after birth.

Without insurance coverage, you could end up with expensive medical bills that can create a financial strain on your growing family. Getting newborn coverage in the first 30 days will help you protect both you and your baby.

If you need to find a plan for your newborn, eHealths services are free to consumers and we offer dedicated support teams to help you manage your plan throughout the year. We offer 24/7 support and the ability to purchase plans through a phone call, live chat, or our website for your convenience. Click this link to find plans in your state.

You May Like: What Causes Fast Heart Rate In Newborns

May My Plan Or Health Insurance Coverage Impose Preexisting Condition Exclusions On My Newborn Child Adopted Child Or Child Placed For Adoption

Under HIPAA, as long as you enroll your newborn child, adopted child, or child placed for adoption within 30 days of the birth, adoption, or placement for adoption, your plan or insurance coverage may not impose preexisting condition exclusions on the child. Further, any future plan may not impose a preexisting condition exclusion, provided the child does not incur a significant break in coverage .

How Many Members Can Be Added To A Family Floater Policy

If you do not have an existing maternity health insurance plan or a groupinsurance plan, then the only option available to you is to get the name of your new-born baby added to your family floater health insurance plan. Most floater plans offer insurance cover for multiple family members, including self, spouse, parents, and dependent children. So, you can easily extend the coverage of the same policy to your new-born baby and enjoy your peace of mind.

It is important for you to note that in most cases, the coverage for a new-born baby starts after 90 days of being born, and the premium for your family floater plan might or might not change after the inclusion of your new-born baby.

Read Also: How To Wrap A Newborn For Photos

Recommended Reading: How To Avoid Diaper Rash In Newborn

Do Babies Need Life Insurance

Thinking about life insurance for your newborn baby may feel a little dark, but itâs never too early to purchase a policy for them.

Purchasing an insurance policy for your baby is a way to help should the unimaginable occur. Life insurance helps you not worry about things like funeral expenses, giving you and your family the time you need to grieve.

Life insurance for your baby doesnât need to be a major investment. Term life policies can often be purchased as add-ons to your own policy, or you can acquire a standalone one. Term insurance is also affordable and can be as cheap as $3 a month.

A permanent insurance policy is more expensive, but it also has the benefit of a cash value option. This will be examined in further detail later, but the cash value allows you to accrue interest on your investment. Keep in mind, though, that the gains might not be as great as other forms of investment, so itâs best to keep your expectations within reason.

Getting Tricare For Your Child

You can get TRICARE for your child in two steps:

You don’t need a Social Security number to register your child in DEERS. Once you have one, update DEERS with that number. > > Learn more.

Read Also: How Many Ounces Of Milk Should A Newborn Drink

If You May Qualify For Medicaid Or The Childrens Health Insurance Program

- Medicaid and CHIP provide free or low-cost health coverage to millions of Americans, including some low-income people, families and children, and pregnant women.

- Eligibility for these programs depends on your household size, income, and citizenship or immigration status. Specific rules and benefits vary by state.

- You can apply for Medicaid or CHIP any time during the year, not just during the annual Open Enrollment Period.

- You can apply 2 ways: Directly through your state agency, or by filling out a Marketplace application and selecting that you want help paying for coverage.

- Learn how to apply for Medicaid and CHIP.

The Mother And/or Father Has Health Insurance Through An Employer

If you have a group health insurance policy through your employer, start by talking to your human resources office. Here are a few questions you should ask:

- How much will it cost to add my newborn to my group plan?

- What are the benefits that are included in that price? Are there any specific to newborns?

- What paperwork do I need to fill out to add my newborn to my group plan?

- What is the deadline to have the paperwork submitted?

- When will the coverage start?

The mother and father of the baby should compare notes on how much it will cost to add the child to the group plan and should also review the benefits of each plan to determine the best value. If one parent has health insurance through an employer, and the other parent has an individual health insurance plan, review the cost and the benefits to see which policy is best for your newborn.

Also Check: Why Do Newborns Have Seizures

Getting Ready For A New Arrival Understanding Health Insurance For Your Growing Family

Whether youâre expecting a baby, adopting, or fostering a child, hereâs how to make sure your newest addition is covered from day one.

Even lifeâs most joyous events come with responsibilities â maybe none more so than preparing for the arrival of a new family member. Whether you are an adoptive parent, a first-time mom or a veteran foster dad, your childâs wellbeing will be your top concern. Once you bring your child home, youâll want to give them all of your attention, so take the time now to look into health coverage options for your growing family.

Todayâs the Day

However long youâve waited for your child, you wonât have to wait for health insurance. Through Covered California, you can add or change coverage as soon as your little one arrives.

Covered California is a free service that helps connect California residents with brand-name health insurance as well as financial and enrollment help for those who need it. Usually, you can only purchase health insurance through Covered California during the yearly sign-up period known as open enrollment. Certain exceptions are granted for life-changing events â and for good reason, having a new child qualifies.

Safeguard Your Family

Keep Your Paperwork Handy

Pregnancy Bills Are Steep

Shilpa Nandwani, 30, a teacher in Austin, Texas, always knew she wanted children. After getting married, in December 2021, Nandwani and her partner both decided to try in vitro fertilization, or IVF.

Shilpa Nandwani and her partner.

Nandwani’s insurance offered access to Progyny, an employer-sponsored fertility and family-building benefit. She and her partner went through the process of egg retrieval, which cost a total of $8,000 for everything, including the sperm donation, embryo genetic testing and frozen embryo transfer for both of them. Without the assistance of Progyny, their bill would have been $32,000.

Fertility treatments such as IVF and intrauterine insemination are becoming more common in the US — some 33% of Americans have turned to fertility treatments or know someone who has, according to a Pew Research Center study. But these treatments come at a huge cost for those who undertake them.

“The road to parenthood isn’t always as easy as what we’ve heard from movies and storybooks,” said , a reproductive endocrinologist and medical director of CCRM Fertility Clinic in New York. Choi noted that one round of IVF with medication can cost more than $25,000, and it often takes two to three cycles to be successful.

Dr. Janet Choi: “The road to parenthood isn’t always as easy as what we’ve heard from movies and storybooks.”

Recommended Reading: What Does Low Blood Sugar Mean In A Newborn